What is coinsurance? 9 mysteries of health insurance-solved.You can learn more about how we ensure our content is accurate and current by reading our editorial policy. We link primary sources - including studies, scientific references, and statistics - within each article and also list them in the resources section at the bottom of our articles.

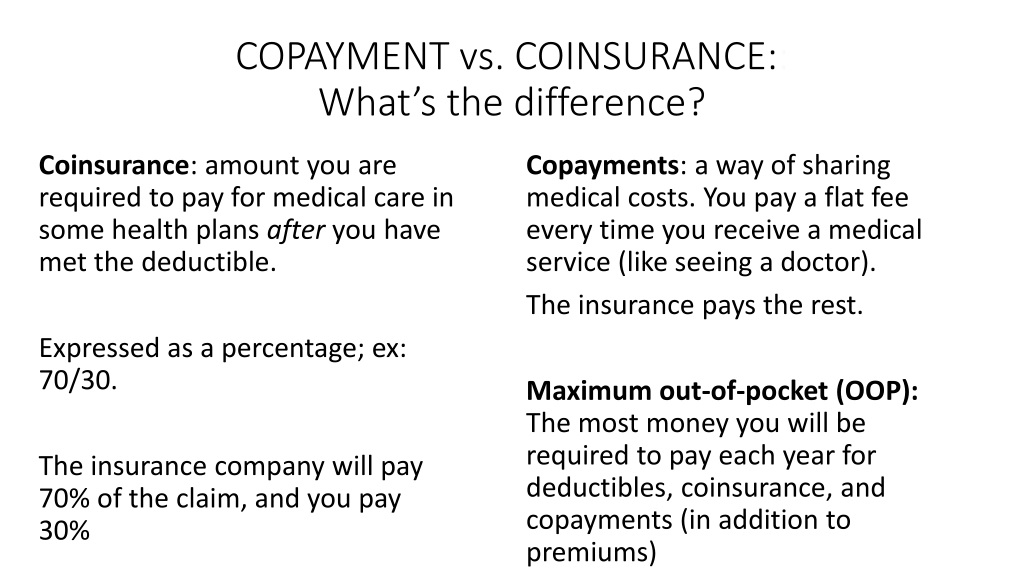

For skilled nursing facility stays, you pay no coinsurance for the first 20 days and 164.50 coinsurance per day for Days 21 through 100. Medical News Today has strict sourcing guidelines and draws only from peer-reviewed studies, academic research institutions, and medical journals and associations. For hospital and mental health inpatient stays, you pay no coinsurance for the first 60 days, 329 coinsurance per day for Days 61 through 90, and 658 coinsurance per day for Days 91 and beyond. Once people reach their out-of-pocket maximum, people will no longer have to pay coinsurance for the rest of the year. If people meet their deductible and continue to need medical services, a high coinsurance percentage will mean they pay more than if they had a lower percentage coinsurance. When you sign up for health insurance through your states Marketplace, you pay a monthly fee to your health plan, called a premium. The higher the percentage that people have to pay for coinsurance, the higher their costs will be.Ī high coinsurance percentage may not be an issue if people do not meet their deductible, as they will only pay coinsurance after reaching their deductible. Risks of having high coinsurance percentage HMO plans require people to use providers within the plan’s network, otherwise, people will need to cover the costs themselves. Until you reach your deductible, youll pay for 100 of out-of-pocket costs. With some plans, such as an HMO plan, people may not have to pay any coinsurance. Coinsurance is a percentage of the cost of a covered service. If people are likely to face high medical costs, they may want to pay a higher monthly premium with lower coinsurance and other out-of-pocket expenses. If people are less likely to require regular medical care and may only need it in an emergency, they may want to pay lower premiums with higher coinsurance. A plan with higher premiums may have lower coinsurance. Does a person want high or low coinsurance?Īccording to, people will typically pay more in coinsurance if they have lower monthly premiums. After that, insurance will cover the total cost of covered services for the remainder of the year. People pay coinsurance until they meet their out-of-pocket maximum. Depending on the type of plan people have, an insurance provider may pay 80% of medical costs, and people pay the remaining 20%. Coinsurance is usually expressed as a percentage. This clause ensures policyholders insure their property to an appropriate value and that the insurer receives a fair premium for the risk. Coinsurance is a percentage of medical costs that people pay after they have reached their deductible.įor example, once a person has reached their deductible, coinsurance will cover a percentage of the costs. Coinsurance is a clause used in insurance contracts by insurance companies on property insurance policies such as buildings.

0 kommentar(er)

0 kommentar(er)